free cash flow yield screener

Every week we scan. Trade Faster With Algorithmic Trade Ideas And Powerful Visuals.

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Total Cash from operations from the companys Cash Flow Statement Minus Capital Expenditure also from the Investing section of the Cash Flow Statement.

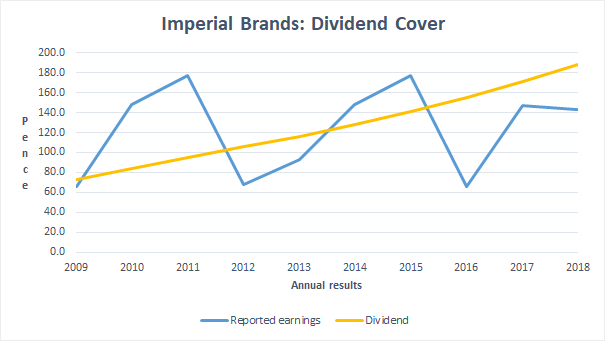

. It is always good idea to calculate such figures yourself. Payout-ratio based on EPSFFO. In fact there have been market cycles where companies with high free cash flow yields have underperformed.

Investors who wish to employ the best fundamental. SP500 -03 DOW 04 FTSE 100 15 NIKKEI 04 OIL 14 GOLD 06. 21 rows Login Get free account Home Screens Tools Login Free Cash Flow Yield Get updates by Email.

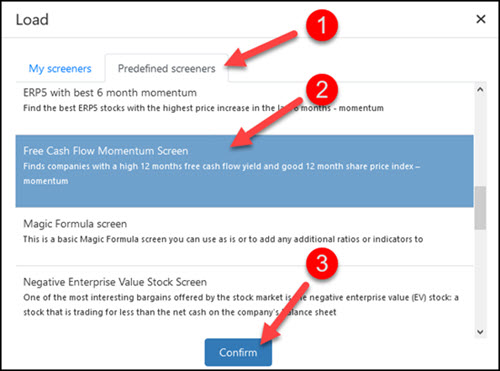

Quantitative Value Investing in Europe. Click image to enlarge. Price Free Cash Flow Ratio Stock Screener with an ability to backtest Price Free Cash Flow Ratio Stock Screening Strategy and setup trade alerts for Price Free Cash Flow Ratio signals.

Five year average free cash flow yield is defined as. The ratio is calculated by taking. See the Big Picture With the Only Tool That Visualizes the Flow.

Based On Fundamental Analysis. Free Cash Flow Yield between 10 and 20. Current dividend yield in percent.

Yes there is indeed a stock screener that can calculate free cash flow of listed stocks. Get the tools used by smart 2 investors. Cash flow stability Cash flow CAGR last 10 years Cash flow CAGR last 5 years Cash flow CAGR estimation Revenue.

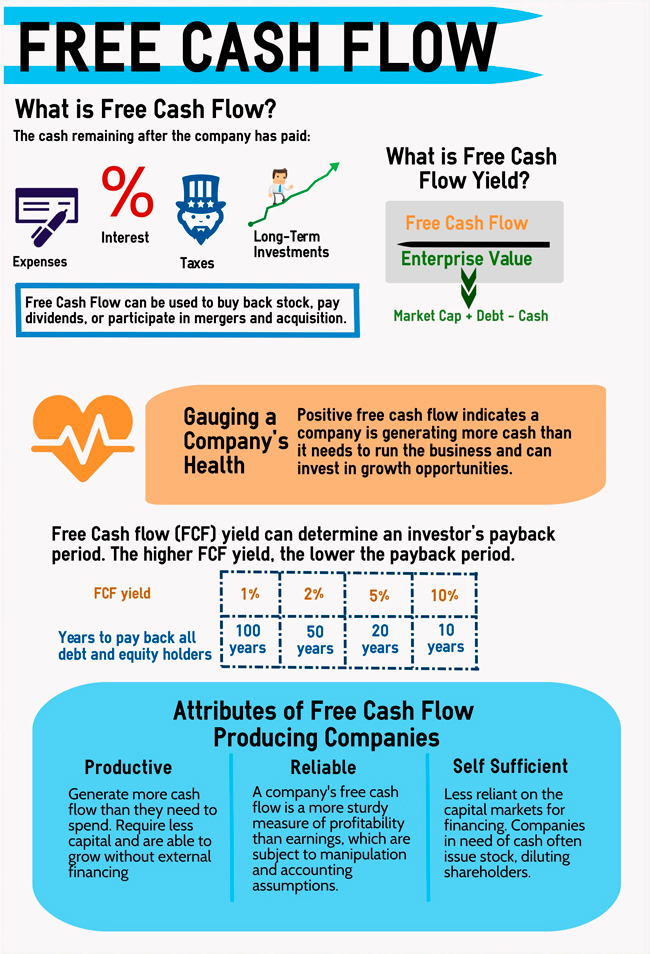

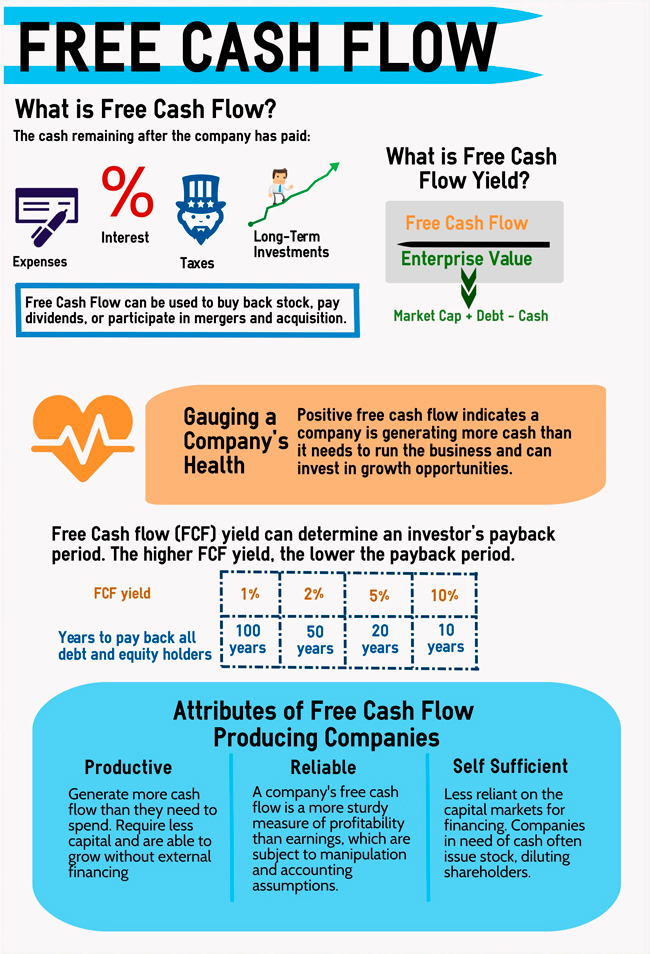

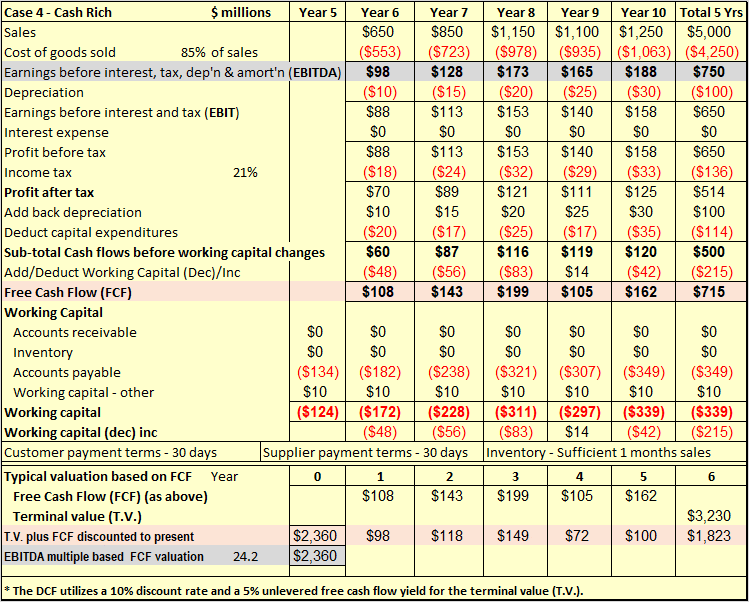

Five year average FCF Current Enterprise Value. What is free cash flow and free cash flow yield Before we go any further lets make sure we know what we are talking about. Free cash flow is the cash that a company is able to generate after paying off all of the bills maintaining existing asset bases and pursuing future growth.

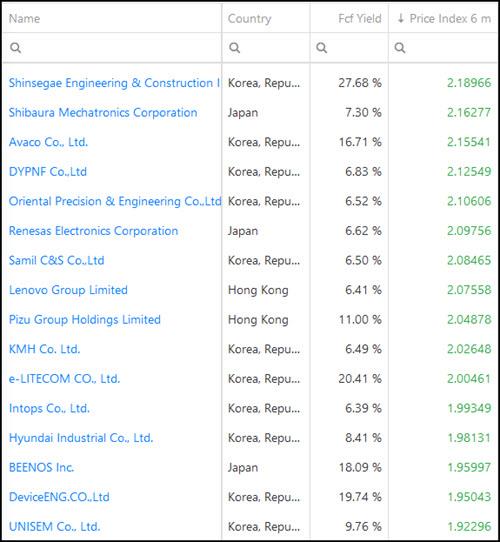

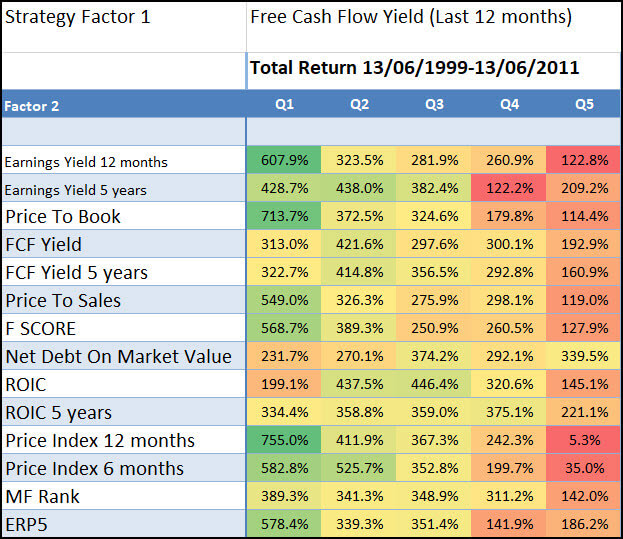

A stock screener that allows you to screen stocks based on Old School Value fundamentals valuation action score and thousands of other metrics. The dividend screener features dynamic metrics long term growth and makes it visibe using dynamic charts. What works for achieving alpha Q1 Quintile 1 represents the cheapest 20 of companies in terms of five year average free cash.

Ad Our Strong Buys Double the SP. Though I would recommend that you calculate FCF on your own to be sure. Rated the 1 Accounting Solution.

Additionally fair values are calculated. Free cash flow yield is really just the companys free cash flow divided by its market value. - a free list of stocks with strong cash flow yield.

Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital expenditures from all cash flow. In case of negative earnings losses 100 percent will be shown.

Backtest your Price Free Cash Flow Ratio trading strategy before going live. With your permission we and our partners may use precise. Below mentioned tool is.

With that said it is clear that a company able to increase and generate FCF will appreciate in value as. Premade Screener Stocks With High Free Cash Flow Yield. Pay-out-ratio based on earnings or FFO for REITS per share within last 12 months.

Pay-out-ratio based on free-cash-flow per share within. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. Ad Tired of Raw Data.

Payout-ratio based on free-cash-flow. Free cash flow is defined as cash from operations - capital expenditure. Ad QuickBooks Financial Software.

Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. 4 rows Login Get free account Home Screens Tools Login Free Cash Flow Yield Get updates by Email. Answer 1 of 4.

We and our partners store andor access information on a device such as cookies and process personal data such as unique identifiers and standard information sent by a device for personalised ads and content ad and content measurement and audience insights as well as to develop and improve products. FCF is what enhances shareholder value and how dividends can be consistently paid. In the Quant Investing stock screener we define Free Cash Flow FCF as.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Watchlists Ideas Screener Data Explorer Charts Saved Work. 352 rows Cash Flow Kings.

Price To Free Cash Flow Backtest Fat Pitch Financials

The Power Of Free Cash Flow Yield Pacer Etfs

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Guide To Stock Screener 1 Stock Screener Investment Tips Debt To Equity Ratio

Mcdonalds Beating Estimates Same Store Sales Up 5 7 What Long Term Dividend Growth Investors Need To Know Https L Dividend Money Centers Stock Screener

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Why Dividend Investors Should Look At Free Cash Flow Seeking Alpha

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fast Free Cash Flow Yield Screener For S Amp P 500 Stocks Using Marketxls Template Included

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

8 Value A Bond And Calculate Yield To Maturity Ytm Cash Flow Statement Value Investing Stock Screener

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)